Which Debt Fund Is Right For Your Goals?

Debt investing is just as crucial as equity investing. Learn why debt funds matter, the different types available, and how to choose the right one based on your financial goals and time horizon.

FINANCIAL PLANNINGFIXED INCOME

Shriraj Attal

11/18/20253 min read

Most investors know the classic thumb rule:

“100 minus your age = the percentage of your portfolio that should be in equity.”

But what about the other side of the equation?

Your debt allocation is just as important — not only for stability but also for liquidity, risk control, and predictable returns.

In a recent video, Aastha Khurana breaks down why debt funds deserve more attention and explains the different types of debt funds available for every time horizon. If you’ve ever wondered, “Which debt fund should I choose?” — this guide simplifies everything for you.

Why Debt Investing Matters

Debt funds often get ignored because they seem less glamorous than equity. But they serve three critical purposes:

1. Stability

Debt instruments provide a cushion during equity market volatility. They help smooth out your portfolio’s overall returns.

2. Liquidity

Many debt funds allow easy redemption, making them ideal for emergency funds or short-term parking of money.

3. Predictable Returns

While not guaranteed, debt funds typically offer more consistency compared to equity.

If equities help you grow your wealth, debt funds help protect it.

What Is a Debt Fund?

A debt fund is a mutual fund that invests in fixed-income instruments such as:

Government securities

Corporate bonds

Treasury bills

Commercial papers

Certificates of deposit

These funds earn returns through interest income and potential capital gains when interest rates change.

Types of Debt Funds Explained

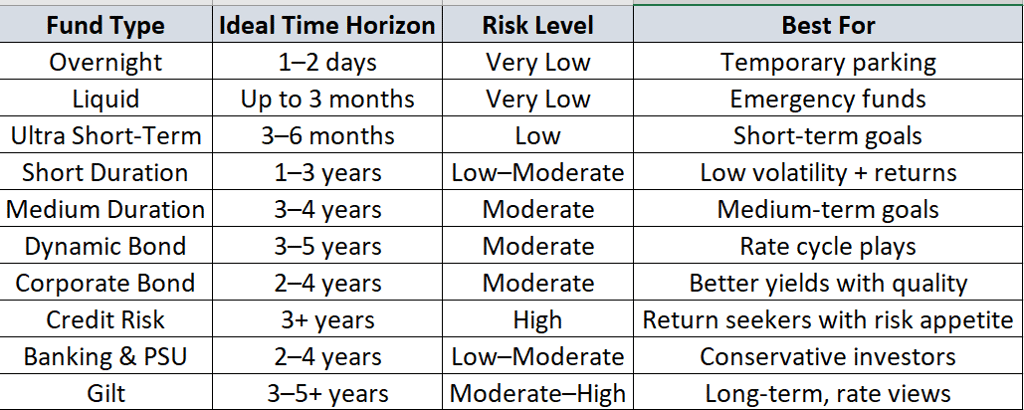

Below is a breakdown of the most commonly used debt fund categories, and when you should consider them.

1. Overnight Funds

Ideal for: 1–2 days

What they invest in: Overnight securities with 1-day maturity

Why choose them:

Safest category

Perfect for parking money temporarily

2. Liquid Funds

Ideal for: Up to 3 months

What they invest in: High-quality short-term instruments

Why choose them:

Useful for emergency funds

Better returns than savings accounts

3. Ultra Short-Term Funds

Ideal for: 3–6 months

Why choose them:

Manage interest rate risk well

Good for short-term goals like rent, insurance payments, travel, etc.

4. Short & Medium Duration Funds

Ideal for: 1–3 years (short duration)

3–4 years (medium duration)

Why choose them:

Better returns than liquid/UST

Slightly higher interest rate risk

5. Dynamic Bond Funds

Ideal for: 3–5 years

Why choose them:

Fund manager actively changes duration based on interest rate cycles

Great for investors who want professional interest-rate strategy

6. Corporate Bond Funds

Ideal for: 2–4 years

What they invest in: High-quality corporate bonds (AA+ and above)

Why choose them:

Lower risk than credit risk funds

Better yields than gilt or treasury instruments

7. Credit Risk Funds

Ideal for: Experienced investors who understand risk

What they invest in: Lower-rated corporate debt

Why choose them:

Higher potential returns

Higher default risk

8. Banking & PSU Funds

Ideal for: 2–4 years

What they invest in: Debt instruments from banks, PSUs, public financial institutions

Why choose them:

Good credit quality

Ideal for conservative investors

9. Gilt Funds

Ideal for: 3–5+ years

What they invest in: Government securities

Why choose them:

No default risk (sovereign backing)

High interest-rate sensitivity → returns fluctuate based on rate changes

Quick Summary Table

How to Choose the Right Debt Fund

Before picking a debt fund, ask yourself:

1. What’s my time horizon?

Your timeline is the most important deciding factor.

2. What’s my risk appetite?

Do you prefer safety, steady returns, or slightly higher yields?

3. What’s the purpose of the money?

Emergency fund, short-term goal, or long-term allocation?

When you match your fund choice to your timeline and risk comfort, debt funds deliver consistent, reliable results.

Conclusion

Debt investing isn’t just a “safe” part of your portfolio — it’s a strategic, essential component that supports your financial growth. Whether you're parking money for a few days or planning for a 5-year goal, there’s a debt fund perfectly suited to your needs.

Understanding the categories will help you avoid mismatches, manage risks better, and build a more balanced, resilient portfolio.

Want Help Selecting the Right Debt Fund?

Choosing the right debt fund can be confusing because each category serves a very specific purpose.

If you want personalised guidance based on:

Your goals

Your time horizon

Your risk appetite

Your tax situation

I’d be happy to help you build the right mix of equity + debt for a well-balanced portfolio.

Feel free to reach out anytime.

Trust

A Partnership built on Trust, Transparency, and Long-term success

Turning your aspirations into reality.

Contact

prosperaa.wealth@gmail.com

+91-8208935082

© 2025. All rights reserved.

Office No.C-3, B-Wing, 1st Floor, Bharat Bazaar, Chikalthana MIDC,

Chattrapati Sambhajinagar, MH

431006

Pune, MH

Mumbai, MH